US Jobless Claims Steady: The latest US job market data shows mixed signals. US jobless claims steady at 248,000 for the week ending June 7, 2025. This matches the revised figure from the previous week. However, continuing claims rose to 1.96 million, the highest since November 2021.

The Labor Department released the report on June 12, 2025. Economists had expected a slight drop. The numbers suggest a stable but tightening job market.

Also Read | US-China Trade Deal Reached: Export Curbs Eased, Tariff Truce Extended

US Jobless Claims Steady: Insights

- US jobless claims steady for the second week in a row.

- Continuing jobless claims hit a 3.5-year high, signaling long-term unemployment may rise.

- The Federal Reserve is likely to keep interest rates unchanged next week.

- Inflation remains low, easing pressure for immediate rate hikes.

- Weak producer prices suggest tariffs aren’t yet raising consumer costs.

Background

The US job market has been strong for months. However, recent data hints at a slowdown. Job growth in May was weaker but still stable. Inflation reports show no major price surges. The Fed has been cautious about cutting rates too soon.

Rising continuing claims could mean workers are struggling to find new jobs quickly. This trend could influence future economic policies.

Main Event

The Labor Department reported that US jobless claims steady at 248,000. This was close to Dow Jones’ forecast of 246,000. The unchanged number suggests short-term layoffs are stable. However, continuing claims jumped by 54,000 to 1.96 million. This is the highest level in over three years.

The Fed meets next week to discuss interest rates. Most experts expect no changes. Officials want more data before making decisions. Recent job and inflation reports support a wait-and-see approach.

A separate report showed producer prices stayed low in May 2025. This means tariffs haven’t pushed costs up yet. Treasury yields and the dollar dipped after the data release. Markets remain cautious about future economic trends.

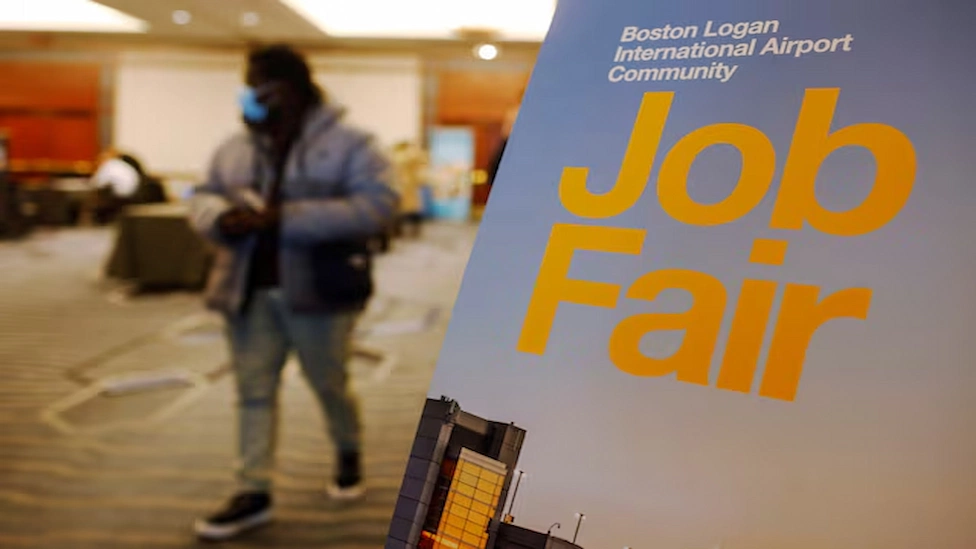

A prospective employee leaves the aviation job expo held at Boston’s primary airport, December 7, 2021.

Photo Credits: REUTERS.

Implications

Workers facing long-term unemployment may struggle more. If demand weakens, businesses could see slower hiring. The Fed’s rate decision will impact loans and investments. Low inflation helps consumers but may limit wage growth. Policymakers must balance growth and stability.

Conclusion

The US jobless claims steady trend suggests short-term stability. Yet, rising continuing claims raise concerns. The Fed will likely hold rates steady next week. Future reports will shape economic policies. Experts warn that prolonged high claims could signal deeper issues. The job market remains a key indicator to watch.