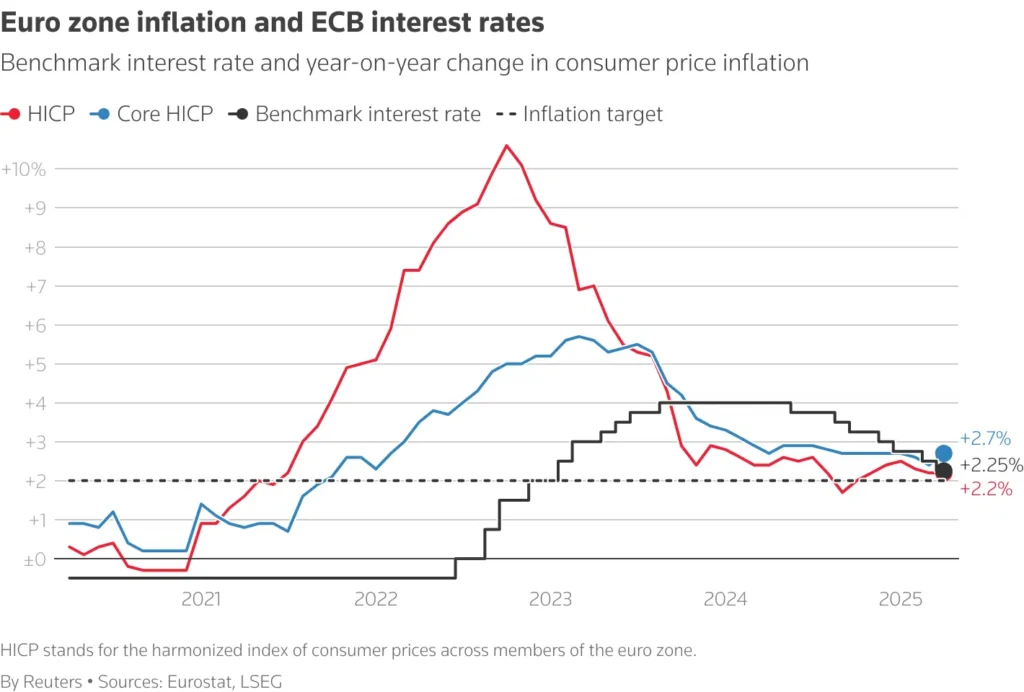

Markets Eye ECB as Euro Zone Inflation Data: On Tuesday, June 3, 2025, investors are closely watching the new Euro zone inflation data for May. This data comes just days before the European Central Bank is expected to cut interest rates. Analysts predict consumer prices rose by 2.0% year-on-year, down from 2.2% in April.

The numbers will shape the ECB’s policy direction. A rate cut of 0.25% is widely expected on Thursday. However, future cuts may pause if inflation concerns return. These developments come as global trade tensions, led by the US and China, continue. Markets remain on edge, waiting for clarity from both the ECB and international trade talks.

Also Read | U.S. Stock Futures Drop as Trump Doubles Steel and Aluminum Tariffs

Markets Eye ECB as Euro Zone Inflation Data: Insights

- Eurozone inflation data for May will be released on Tuesday.

- Forecasts show a 2.0% annual rise in prices, down from 2.2% in April.

- The ECB is expected to cut interest rates by 0.25% to 2.0% this Thursday.

- Investors are unsure if more cuts will follow after this one.

- The eurozone economy is doing slightly better than expected.

- Long-term inflation risks are slowly returning to the radar.

- US trade tariffs create added pressure on global markets.

- Legal uncertainty around US tariffs adds confusion for businesses.

- Trump wants new trade offers from major countries by Wednesday, June 4, 2025.

- A meeting between Trump and Xi Jinping may affect market direction.

Background

Inflation in the eurozone has been a key concern for policymakers. The ECB has kept rates high to fight rising prices. However, inflation is now slowing, leading to expectations of rate cuts. In April, the consumer price index rose by 2.2%. Analysts now believe May’s Euro zone inflation data will show a slight drop.

This change gives the ECB more room to ease monetary policy. At the same time, global trade tensions, especially between the US and China, have made markets more unstable. These combined factors make the ECB’s next steps crucial for both Europe and the world.

Main Event

On Tuesday, June 3, 2025, the European Union will release its flash estimate of Euro zone inflation data for May. Markets expect annual inflation to slow to 2.0%, down from 2.2% in April. This report is seen as a key signal for the European Central Bank’s next move.

The ECB is widely expected to cut interest rates by 0.25 percentage points this Thursday. That would bring the main rate to 2.0%. While this cut seems certain, investors believe further cuts may be delayed. One reason is that the eurozone economy is showing unexpected strength.

At the same time, inflation fears are slowly returning, making long-term policy decisions more difficult. Another concern is the impact of global trade issues. US tariffs remain unclear due to mixed court rulings and changing policy signals.

On the trade front, US President Donald Trump has asked for new trade offers from major partners by Wednesday, June 4, 2025. His team wants to speed up talks ahead of a self-imposed five-week deadline. These pressures could affect European exports and overall business confidence.

Markets are also watching for signs of Trump’s expected meeting with China’s Xi Jinping. Whether this meeting improves or worsens relations is still unknown.

The euro fell slightly on Monday, while the US dollar dropped to a six-week low. Investors are waiting to see how the ECB will respond to the changing environment, shaped by slowing inflation and global uncertainty.

This chart tracks Eurozone inflation trends alongside the European Central Bank’s corresponding interest rate decisions over time.

Photo Credits: REUTERS.

Implications

The fresh Euro zone inflation data will likely confirm that price growth is slowing. This gives the ECB a chance to begin rate cuts without stoking inflation fears. Lower rates could help businesses and households by reducing borrowing costs. However, if inflation stays above 2%, the ECB might pause further cuts.

Meanwhile, global trade tensions are hurting investor confidence. Europe depends heavily on trade, so new tariffs or slow negotiations could delay recovery. Currency markets may also react if the ECB’s move differs from what investors expect.

Businesses, policymakers, and financial markets must now adjust to both local economic shifts and global risks.

Conclusion

The upcoming Euro zone inflation data could be a turning point for Europe’s economy. A drop to 2.0% would likely confirm the ECB’s plan to cut rates. Yet, concerns about future inflation and unstable global trade may limit further actions. The next few days are critical.

Investors will watch both the ECB’s decision and updates from US-China trade talks. Any major change in these areas could affect financial markets worldwide. For now, Europe waits for signs of economic relief or more uncertainty ahead.