China Rare Earth Export Ban Disrupts European Auto Supply Chains: BMW has warned that its supplier network is facing delays due to a China rare earth export ban. This move, announced in April, has disrupted global supply chains. Several European auto plants have suspended production.

China dominates this mineral market, and its decision is considered a strategic tool in ongoing trade tensions. The ban affects automakers, aerospace firms, and electronics manufacturers across the globe. The supply shortages are already impacting operations in Europe and could worsen if restrictions remain.

Also Read | Markets Eye ECB as Euro Zone Inflation Data Sparks Rate Cut Expectations

China Rare Earth Export Ban Disrupts European Auto Supply Chains: Insights

- BMW reports supplier disruption but says its production is still running.

- CLEPA confirms some European plants have stopped due to shortages.

- Only 25% of rare earth export requests have been approved by China.

- Automakers are urging governments to act fast.

- Alternatives to rare earths are under development but not yet scalable.

- Trade tensions between China and the U.S. are fueling the export control.

Background

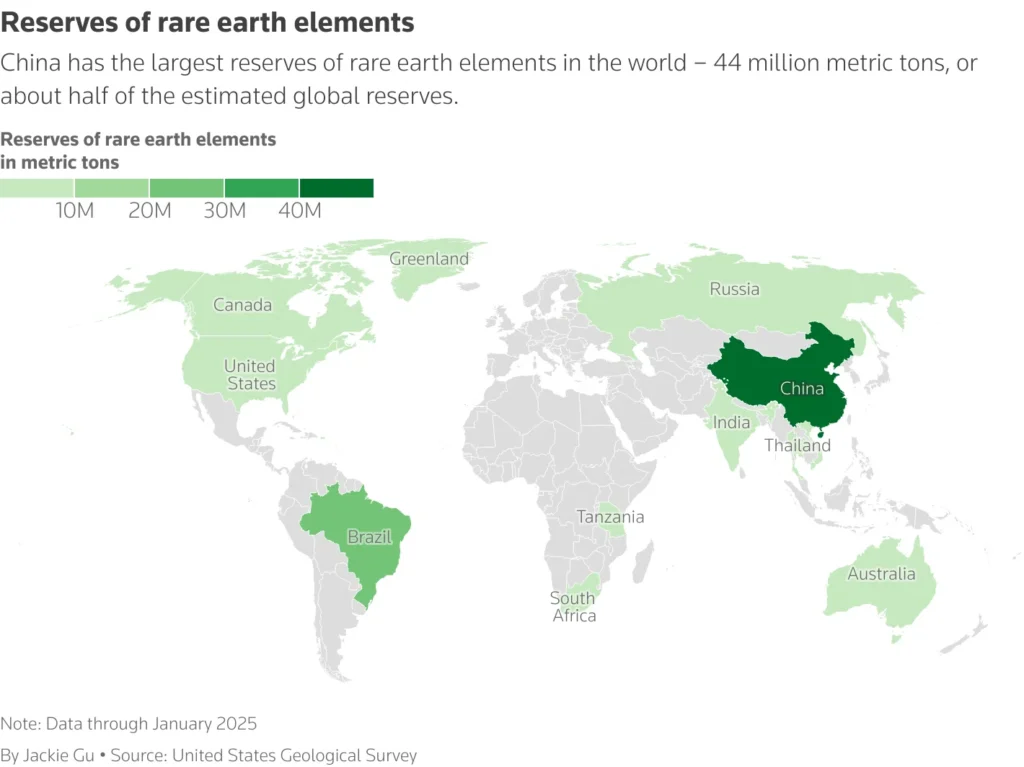

China produces about 90% of the world’s rare earth minerals. These materials are essential for electric cars, aerospace parts, and defense systems. In April, China limited exports of rare earths and related magnets. The move is part of its trade standoff with the United States.

These curbs apply globally, not just to U.S.-linked trade. Past trade disputes between the two nations have included tariffs, sanctions, and supply chain restrictions. The China rare earth export ban adds new pressure on already stretched industries.

Main Event

On Wednesday, BMW confirmed that its suppliers felt pressured by the China rare earth export ban. Though BMW’s production lines are still running, it warns the supply strain may worsen. CLEPA, Europe’s automotive supplier group, said some plants have already shut down. They report that just one in four export licenses have been approved. The rest were rejected on what CLEPA calls “procedural grounds.”

Other major players like General Motors, Volkswagen, and ZF are also assessing their supply lines. Some have stockpiles, but only for weeks or months. Wolfgang Weber of ZVEI said firms are trying to solve the issue alone, especially those still working in China. Swedish safety parts maker Autoliv said it’s not yet impacted but has created a task force to monitor risks.

Companies are exploring rare-earth-free technologies. BMW uses magnet-free motors in its new EV line. Still, more minor parts like wipers and windows rely on rare earths. Volkswagen said it has seen some rare earth licenses approved for its contractors, but the process remains unclear.

Global Rare Earth Reserves (in metric tons): China dominates with the largest share, as its export ban disrupts European auto supply chains.

Photo Credits: REUTERS and United States Geological Survey.

Implications

The China rare earth export ban threatens to halt more European production lines and beyond. Auto companies may face delayed deliveries and increased costs. Governments are under pressure to ease supply risks and secure alternatives. Smaller suppliers could suffer the most if inventories run out.

The wider green energy and tech sectors are also at risk. These industries rely heavily on rare earths to meet clean energy goals. The ripple effects of this ban could slow the global energy transition.

Conclusion

As trade talks between China and the U.S. resume, rare earths will be a top issue. Industry leaders want urgent action to resolve the supply crisis. However, the China rare earth export ban may continue to strain global manufacturing. If no solution is found soon, more production halts are likely.

Some companies are pivoting to innovation, but complete independence from China’s rare earth supply remains years away.